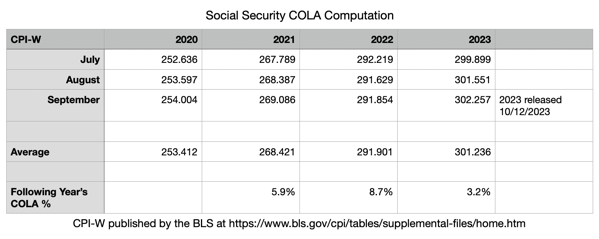

The BLS released the CPI-W for September 2023 today.

This allows the Social Security administration to compute the COLA (Cost of Living Adjustment) which will apply to Social Security benefits in 2024. The COLA for an upcoming year is based on the changes to the CPI-W over the three overlapping 12 month periods ending in July, August, and September of a given year.

We have constructed our own calculator for this which allowed us to play with what the COLA might have been using various assumed changes in inflation. But now we have the actual numbers, the results are the following (our own computation):

As you can see, this means that Social Security benefits will increase for anyone over age 62 (because that’s when COLAs start to apply) by 3.2% for 2024.

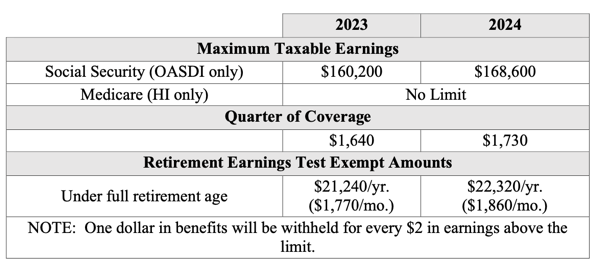

Additionally, the amount of earnings on which one pays SS taxes in 2024 will go up to $168,600 from 2023’s $160,200.

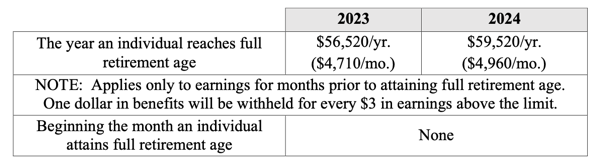

(The following images came from SSA.gov)

So the amount of earnings on which one pays SS taxes in 2024 will go up to $168,600 from 2023’s $160,200.